Why Pay Thousands for Quality of Earnings?

How AI Tools Are Changing the Game for SMB Financial Analysis

Before you shell out four to five digits on a “Quality of Earnings” engagement for your small business acquisition, how about dropping $20 for a ChatGPT subscription?

Yes, I’ll receive much hate for this, but I’m not looking for new friends, so I pulled the financial statements from a nanocap publicly traded company for illustration purposes.

As you will see, AI does a great job of analyzing financial statements. If you make it until the end of the post, you’ll see you can also get creative with the AI…

Overview and Key Observations

The Company has experienced a challenging year, as indicated by the financial statements provided. Here are the key points and insights from each of the statements:

Balance Sheet Analysis

Current Assets & Liabilities:

The total current assets are relatively stable year-over-year, increasing slightly from $13.2 million in 2022 to $13.6 million in 2023.

The cash position improved from $4.78 million to $5.33 million, which is a positive indicator of liquidity.

Accounts receivable decreased from $4.79 million to $4.31 million, possibly indicating improved collections or lower sales volume.

Inventories slightly decreased, which might suggest either improved inventory management or lower purchasing to match reduced demand.

Long-Term Assets:

Property and equipment decreased from $7.92 million to $7.00 million, possibly due to depreciation and asset sales.

A significant decline in tradenames and other unamortizable intangible assets from $1.53 million to $217,000 suggests an impairment, which is later confirmed in the income statement.

Liabilities:

A substantial decrease in current liabilities from $16.4 million to $8.6 million. The reduction is primarily due to the elimination of the $5.71 million in notes payable and the $2.01 million line of credit, which indicates a significant restructuring or repayment of debt.

Non-current liabilities increased due to a new note payable of $8.85 million. This suggests refinancing of the previous obligations or new financing arrangements.

Overall, the company's total liabilities increased slightly from $16.8 million to $18.5 million.

Equity:

The equity has decreased from $6.59 million in 2022 to $2.81 million in 2023, reflecting the net losses incurred over the year and the possible dilution of equity.

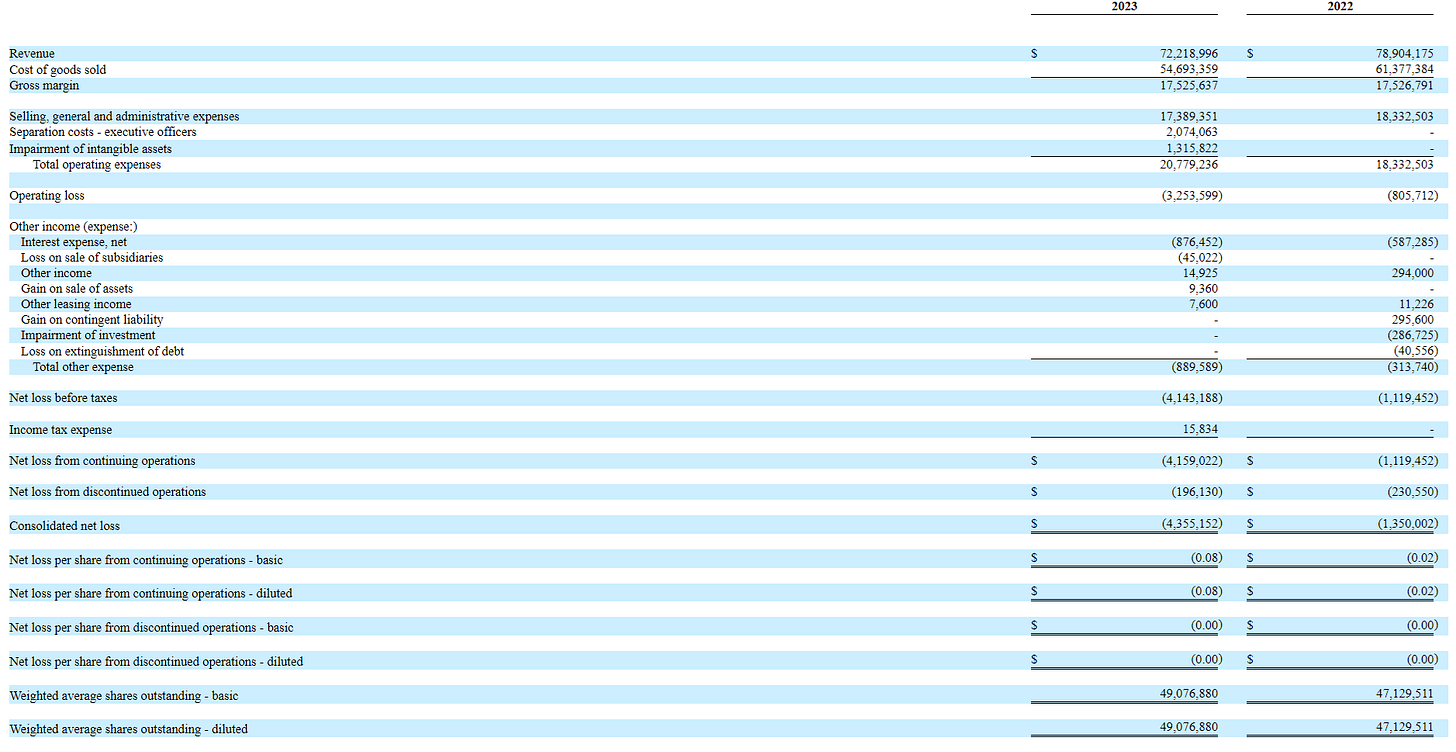

Profit & Loss Statement Analysis

Revenue & Gross Margin:

Revenue dropped by approximately 8.5%, from $78.9 million in 2022 to $72.2 million in 2023, reflecting either reduced demand or operational challenges.

The gross margin remained flat year-over-year at around $17.5 million, indicating that the company managed its cost of goods sold (COGS) effectively despite the revenue drop.

Operating Expenses:

Significant increase in operating expenses, particularly due to separation costs for executive officers ($2.07 million) and impairment of intangible assets ($1.32 million). These one-time charges severely impacted the operating income.

The company's SG&A expenses saw a minor decrease, indicating some control over operational costs.

Net Loss:

The company’s net loss from continuing operations increased significantly from $1.12 million in 2022 to $4.16 million in 2023, primarily driven by higher operating expenses and impairment charges.

The total consolidated net loss was $4.36 million in 2023 compared to $1.35 million in 2022, indicating a tough year for the company financially.

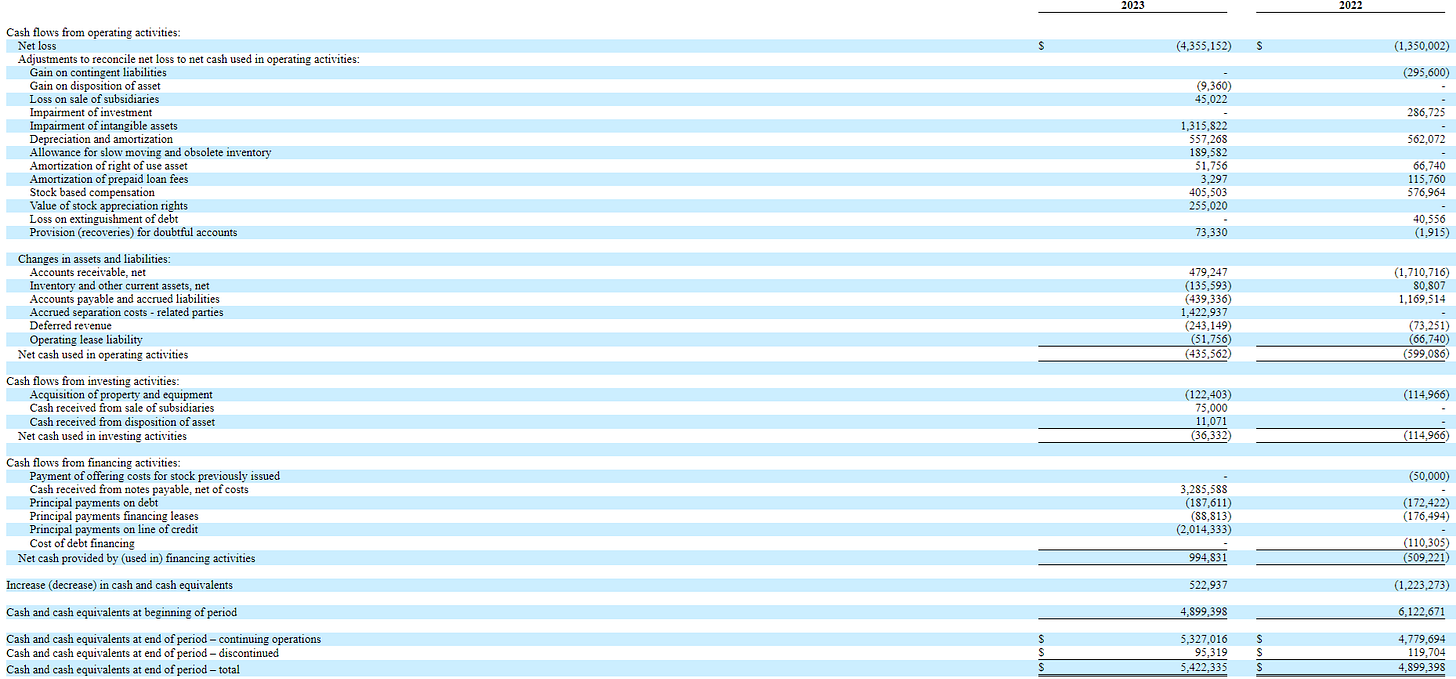

Cash Flow Statement Analysis

Operating Activities:

The company used less cash in operating activities in 2023 ($435k) compared to 2022 ($599k), despite a higher net loss. This could be due to working capital adjustments and non-cash charges such as depreciation and impairments.

Investing Activities:

Cash used in investing activities was relatively low, with $36k in 2023 compared to $115k in 2022. The minimal investment suggests a conservative approach towards capital expenditure.

Financing Activities:

The company raised $3.29 million from new notes payable, helping to offset debt repayments and other financing costs.

The net cash provided by financing activities was $994k, which helped improve the cash position.

Cash Position:

The company ended the year with a slight increase in cash and cash equivalents at $5.42 million, reflecting the careful management of cash flow amidst the challenges.

The company faced a challenging year, with declining revenues and significant one-time expenses impacting profitability. The balance sheet reflects a significant restructuring of debt and a reduction in liabilities, but at the cost of equity dilution and continued net losses.

The company’s ability to generate cash from operating activities improved marginally, but the outlook remains cautious given the declining revenue trend and the continued net losses. Moving forward, the focus should likely be on stabilizing revenues, further reducing operating expenses, and managing debt effectively to return to profitability.

If you are considering any strategic actions (e.g., acquisition, investment, or restructuring), this analysis suggests a careful review of future revenue potential and cost management strategies.

Balance Sheet:

Income Statement

Cash Flow Statement

Cash Flow-based Quality of Earnings

Analyzing the Quality of Earnings (QoE) for company based on the provided consolidated cash flow statement requires focusing on several key areas:

1. Net Loss and Adjustments

Net Loss: The company reported a net loss of $4.36 million in 2023, compared to a loss of $1.35 million in 2022. This significant increase in net loss is a negative indicator, signaling worsening financial performance.

Adjustments: There are several adjustments to reconcile the net loss to net cash used in operating activities. The most significant of these include:

Impairment of intangible assets: $1.32 million in 2023, which indicates potential issues with the value of the company’s intangible assets.

Stock-based compensation: $405,503 in 2023, down from $576,964 in 2022, which is still a notable non-cash expense that impacts reported earnings.

Accounts receivable, net: A positive adjustment of $479,247 in 2023, compared to a negative adjustment of $1.71 million in 2022, indicating an improvement in collections or a decrease in sales.

2. Cash Flows from Operating Activities

Net Cash Used: The company used $435,562 in operating activities in 2023, a reduction from $599,086 used in 2022. This slight improvement could suggest some stabilization in operational cash flows, but the ongoing negative cash flow is still a concern.

Changes in Working Capital:

Accounts Receivable: Improvement in 2023 suggests better cash collection or a reduction in sales, which requires further examination.

Accounts Payable and Accrued Liabilities: Decreased by $439,336 in 2023, down from an increase of $1.17 million in 2022, which could indicate payment of outstanding liabilities or a reduction in operational expenses.

3. Cash Flows from Investing Activities

Net Cash Used: The company used $36,332 in investing activities in 2023, down from $114,966 in 2022. The lower cash outflow is primarily due to the cash received from the sale of subsidiaries ($75,000) and asset disposition ($11,071).

Capital Expenditures: The consistent investment in property and equipment ($122,403 in 2023) suggests ongoing capital investment, although this is relatively modest.

4. Cash Flows from Financing Activities

Net Cash Provided: The company generated $994,831 from financing activities in 2023, a significant turnaround from the $509,221 used in 2022. This positive cash flow is mainly due to the cash received from notes payable ($3.29 million), which offsets debt repayments and other financing costs.

Debt and Interest Payments: Despite the cash infusion from financing, the company is still facing substantial interest payments ($802,076 in 2023), which could indicate a high debt burden.

5. Liquidity

Cash Balance: The company ended 2023 with a total cash balance of $5.42 million, up from $4.9 million in 2022. This increase in cash reserves is a positive indicator of liquidity, though the reliance on financing activities to bolster cash is concerning.

6. Non-Cash Activities

Significant Non-Cash Items: These include the reclassification of fixed assets as held for sale ($649,984) and issuance of common stock for a severance agreement ($168,000). These non-cash activities impact the balance sheet but do not directly affect cash flows.

Overall Quality of Earnings Analysis:

The overall QoE for The Company appears to be low, primarily due to the following factors:

High Non-Operating Adjustments: Significant adjustments such as impairments, stock-based compensation, and non-recurring gains/losses suggest that the company's earnings are heavily influenced by non-operating items.

Negative Operating Cash Flow: The persistent negative cash flow from operations indicates that the company is not generating sufficient cash from its core business activities to sustain itself.

Reliance on Financing: The positive cash flow from financing activities, driven by new debt, indicates a reliance on external funding to maintain liquidity, which could be risky if the company cannot stabilize its operations.

The company's QoE would benefit from improved profitability and reduced reliance on non-operating adjustments and external financing. The increase in net loss, significant impairments, and negative operating cash flow are red flags that could concern investors or lenders looking for stable and sustainable earnings.

Key Points to Consider:

Revenue Analysis:

Revenue Decline: Revenue decreased from $78.9 million in 2022 to $72.2 million in 2023. This decline suggests potential challenges in maintaining or growing the top line, which can impact the quality of earnings.

Cost of Goods Sold (COGS): COGS decreased in line with revenue, from $61.4 million in 2022 to $54.7 million in 2023. However, the gross margin remained nearly unchanged, indicating the company managed to maintain its pricing or cost structure despite lower sales.

Operating Expenses:

Increased Operating Expenses: The company's operating expenses increased from $18.3 million in 2022 to $20.8 million in 2023. Significant factors include $2.07 million in separation costs for executive officers and a $1.32 million impairment of intangible assets.

Non-Recurring Expenses: The separation costs and impairment of intangible assets are non-recurring and significantly impacted the operating loss. These expenses must be adjusted to assess the normalized earnings.

Operating Loss:

The operating loss increased substantially from $805,712 in 2022 to $3.25 million in 2023. The increase is largely due to the non-recurring separation costs and impairment expenses mentioned above.

Other Income and Expenses:

Interest Expense: Interest expense increased to $876,452 from $587,285, reflecting higher debt levels or less favorable financing terms.

Loss on Sale of Subsidiaries: The company incurred a $45,022 loss on the sale of subsidiaries, which is another non-recurring item.

Net Loss: The overall net loss for 2023 was $4.36 million, up from $1.35 million in 2022. Much of this loss can be attributed to non-operating or one-time expenses.

Cash Flow Analysis:

Operating Cash Flow: The company generated a net cash outflow of $435,562 from operating activities in 2023, compared to $599,086 in 2022. This reduction in outflow is a positive sign, but the overall negative cash flow suggests operational challenges.

Investing and Financing Activities: Cash flow from investing activities shows minimal impact, while financing activities provided a positive net cash flow, largely due to new notes payable.

Balance Sheet Considerations:

Assets and Liabilities: The balance sheet shows a decline in total assets from $23.42 million in 2022 to $21.32 million in 2023. The company's liabilities increased, and stockholders' equity decreased significantly, which is concerning.

Current Liabilities: There was a substantial decrease in current liabilities from $16.4 million to $8.64 million, primarily due to the reduction in notes payable and line of credit.

Quality of Earnings Assessment:

Earnings Adjustments: Adjusting for non-recurring items such as separation costs, impairment of intangible assets, and the loss on sale of subsidiaries, the adjusted earnings would be less negative. However, even with these adjustments, the company's earnings quality remains low due to ongoing operational challenges, declining revenue, and increasing interest expenses.

Sustainability: The revenue decline, coupled with rising expenses, particularly interest and one-time costs, indicates that the current earnings may not be sustainable without significant operational improvements.

Cash Flow Concerns: The negative operating cash flow and reliance on financing activities to maintain cash levels suggest liquidity issues and potential difficulties in sustaining operations without external funding.

The quality of earnings for The Company is relatively low for 2023. The company has been impacted by non-recurring expenses and declining revenue, leading to a significant increase in net loss. While adjustments for non-recurring items may present a less negative view, the underlying operational challenges and cash flow issues indicate that the earnings may not be reliable or sustainable without significant improvement in the company's core operations.

Once you’ve fed in the financial statements, consider getting a little creative with your final prompt:

“What surprised you most in your analysis of this company?”

In analyzing The Company, what surprised me most was the significant impact of non-recurring expenses on the company's financial performance in 2023, particularly the $2.07 million in separation costs for executive officers and the $1.32 million impairment of intangible assets. These non-recurring items dramatically increased the operating loss and net loss for the year. This suggests that the company's earnings quality was heavily influenced by these one-time events, which could be misleading if one only looked at the net income figures without understanding the underlying causes.

Additionally, the sharp decline in stockholders' equity from $6.59 million in 2022 to $2.81 million in 2023 was unexpected. This drop reflects both the operational struggles and the effect of non-recurring items, indicating potential concerns about the company's long-term financial stability.

Finally, the company's reliance on financing activities to maintain its cash position, while operational cash flow remained negative, also stood out. It indicates potential liquidity issues and raises questions about how sustainable the company's operations are without external financing. This reliance on financing suggests that the company may be facing more profound operational challenges than a simple year-over-year fluctuation in expenses.

To wrap it up, three separate analysis were performed. Pass one was done as an overview of all three statements. Pass two was done for QofE on just the Cash Flow Statement, and Pass three was a QofE using all three statements.

If you’re in the middle of crafting an LOI for a small business in the neighborhood of $500k to $1m EBITDA, connect with me and I’ll run your financial statements through the AI.

What do you think? let me know!